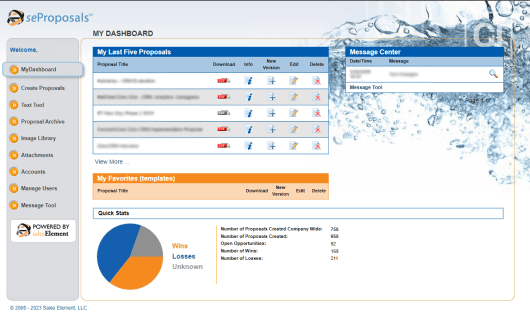

Key Features of Effective Property & Casualty Insurance Quoting Software

Integration with Existing Systems

Your CPQ should easily integrate with your existing CRM, policy administration system, claims system, and other core insurance platforms.

Rules-based Underwriting

A robust CPQ tool recognizes the complexity of product configurations, offering multiple options and variations. The inclusion of a visual product configurator offers a tangible feel, granting both sales representatives and customers a firsthand view of their custom product as it’s designed.

Dynamic Pricing

Adjust pricing based on real-time data, underwriting criteria, or risk assessment. This ensures accurate pricing for complex insurance products.

Quote Generation

Time is of the essence. Your property and casualty insurance quoting software solution should be adept at producing error-free, professional quotes promptly, coupled with features for saving, editing, and tracking these quotes.

Approval Workflows

Streamline the renewal process and easily make policy changes with updated quotes.

Document Generation

Once a quote is finalized, the system should automatically generate necessary documents like proposals, binders, or policy declarations.

Reporting and Analytics

Gain insights into your quoting process, common policy configurations, win-loss ratios, and other metrics to make informed decisions.

Cloud-based Solution

A cloud-based CPQ can offer accessibility from anywhere, scalability, and reduced IT maintenance costs.

Security

Given the sensitive data involved, the property and casualty insurance quoting software solution should adhere to the highest security standards, ensuring robust data protection for you and your customers.

Collaboration Features

Enable teams to collaborate on complex quotes or policies, ensuring the best outcomes for clients.

Multi-language and Multi-currency

If your company operates internationally, the software should handle multiple languages and currencies.